An early proposal

Published 8:30 am Thursday, March 7, 2019

The Jessamine County Fiscal Court is bracing for financial crunch for the 2019 fiscal year.

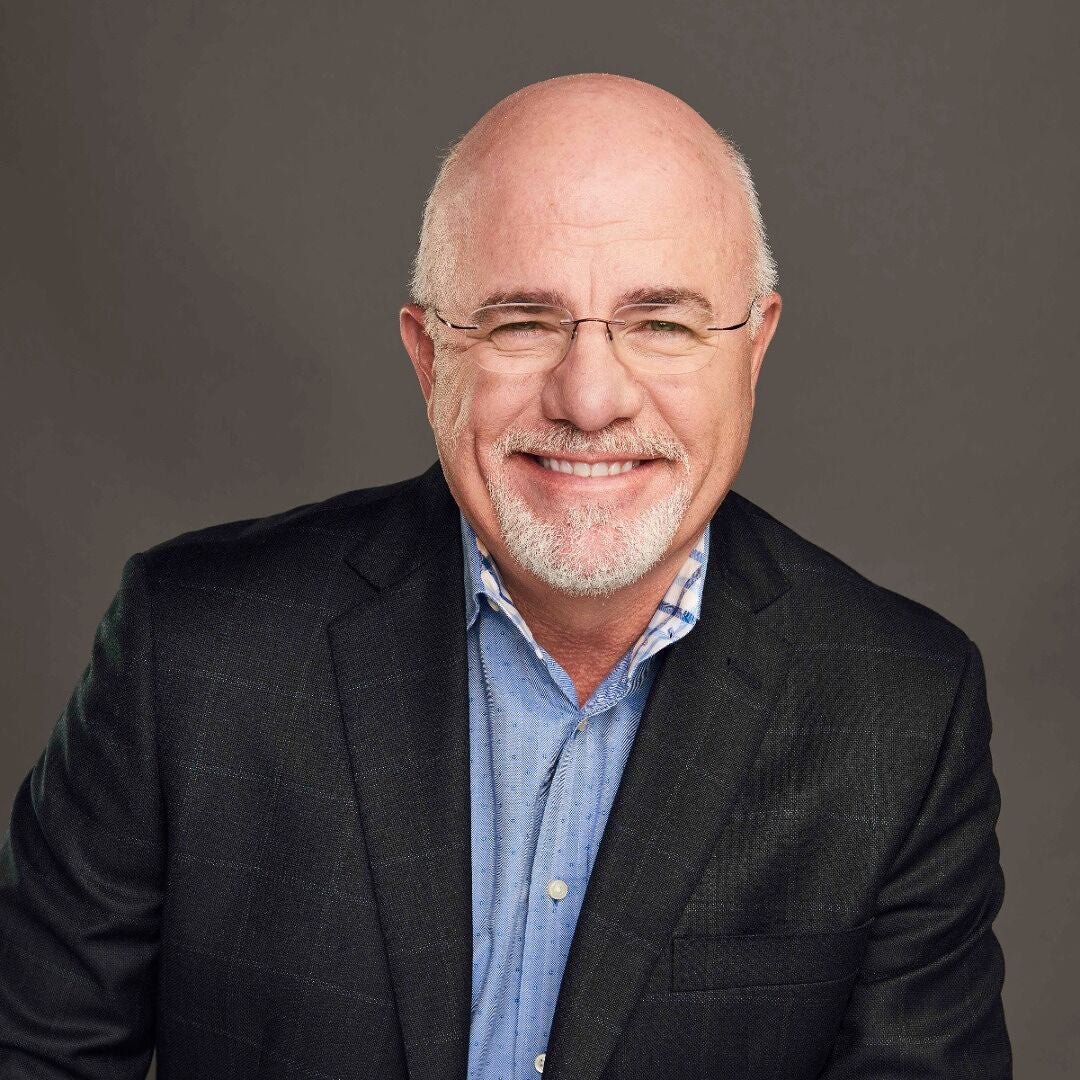

After a workshop with department heads, and an open house held last month to discuss improvements in the county, the Jessamine County Fiscal Court recently heard the first reading on an ordinance to increase revenue in the county which would impose a 9 percent license fee on insurance companies for home, auto and life insurance policies in the unincorporated areas of the county.

A second reading of the ordinance will take place at the next fiscal court meeting, scheduled for 4 p.m. March 12.

“It is similar to what Wilmore and Nicholasville have had in place for years,” Jessamine County Judge-Executive David West said. “Nicholasville and Wilmore already do (this) and there are 40 plus counties in Kentucky that have insurance premiums.”

Currently, the City of Nicholasville’s insurance premium rate is established at 9 percent, which will increase to 10 percent on July 1st. The City of Wilmore also currently has an insurance premium tax set at 7 percent.

West said the deadline to submit this ordinance to the state is March 23. The ordinance will go into effect July 1 and would establish insurance companies’ license fee rates of 9 percent of the first-year premium for all policies, excluding health insurance, and thereafter on a calendar year basis. The funds will be budgeted for the 2019-2020 fiscal year. The deadline for the county to submit its new budget to Frankfort is June 30th.

“It will be (entered into) the general fund,” West said. “As we saw at the open house our pension contributions alone in next four years (will) increase (by) $1.3 million. Most of it will go there from an unfunded mandate from the state passed along to the counties.”

West said there is no way to tell how many policies in Jessamine County will be affected or how much the county looks to gain in revenue from this ordinance until it goes into effect.

When asked if the home insurance fee would be built into the escrow accounts, West said, “I would say built into the mortgage, but there is no law that says they have to pass it on to consumers.”

For where the county currently sits as far as revenue vs. expenses, West said all of the departments are on track with budgeted amounts. Other efforts to cut expenses are carefully managed by department heads. For ways to grow revenue, countywide alcohol sales are being investigated and the new economic development park is currently being bid on, West said.